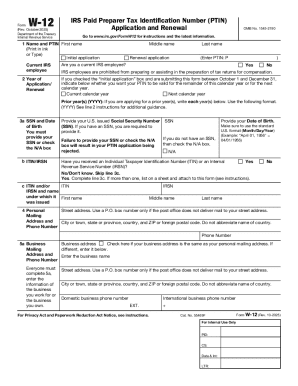

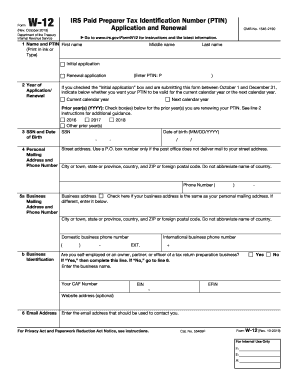

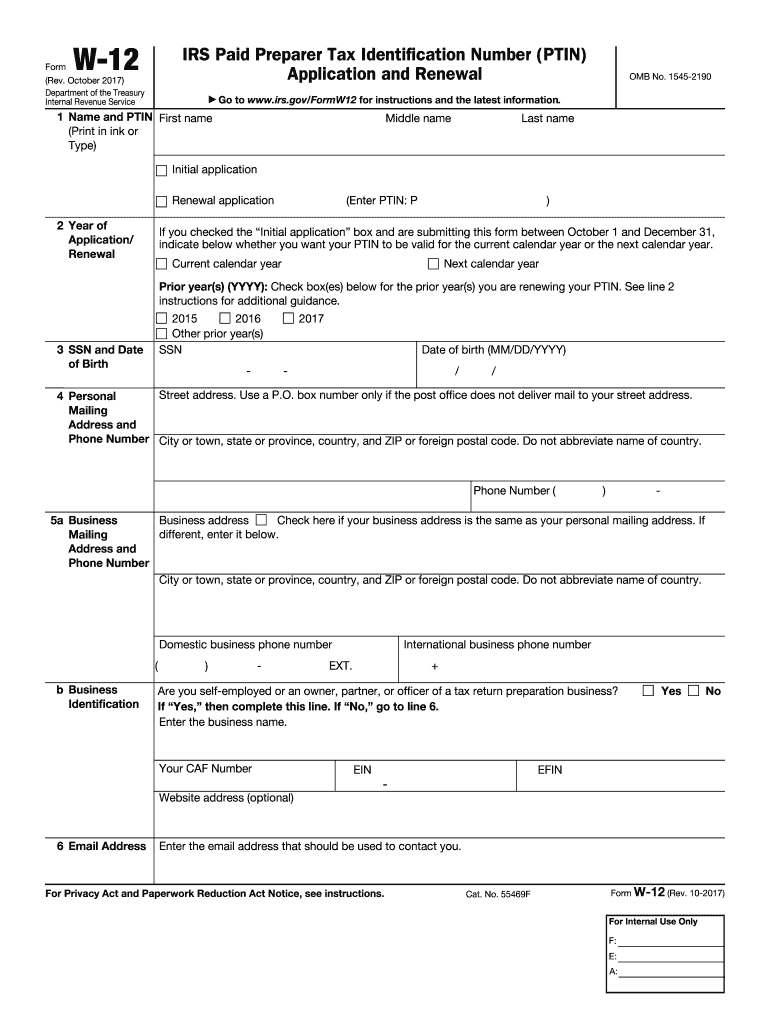

IRS W-12 2017 free printable template

Instructions and Help about IRS W-12

How to edit IRS W-12

How to fill out IRS W-12

About IRS W-12 2017 previous version

What is IRS W-12?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

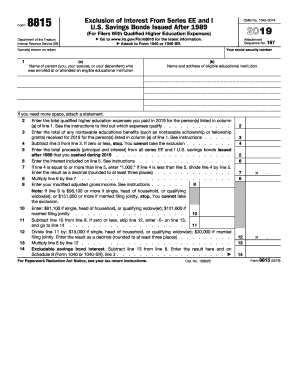

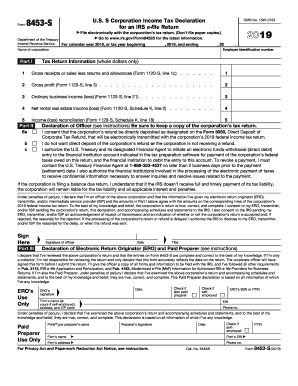

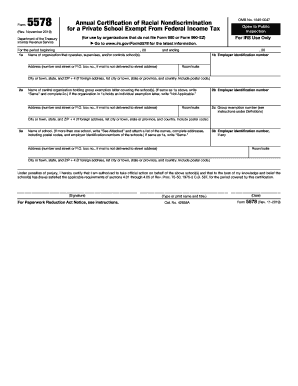

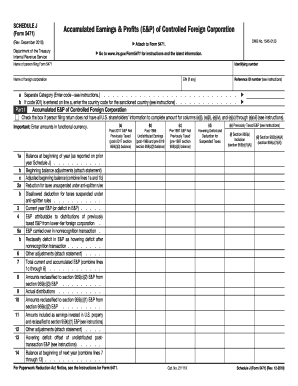

Is the form accompanied by other forms?

FAQ about IRS W-12

How can I correct mistakes on my IRS W-12 after filing?

If you've made an error on your IRS W-12, you can amend the form by submitting a corrected version along with a brief explanation of the changes made. Ensure it is marked correctly as a corrected form to avoid confusion. It's advisable to keep a copy of both the original and the amended version for your records.

How can I check the status of my IRS W-12 submission?

You can verify the status of your IRS W-12 by accessing the IRS online system or contacting the IRS directly. Keep your submission confirmation details handy, as you may need these to inquire about processing. Common e-file rejection codes can also provide insights into any issues encountered during submission.

What are the best practices for keeping records of my IRS W-12 submissions?

It's important to maintain records of your IRS W-12 submissions for a minimum of three years. This period allows you to defend against potential audits or inquiries. Ensure that your records are secure yet accessible, taking advantage of both digital and physical storage solutions to enhance data security.

What should I do if I receive an audit notice related to my IRS W-12?

If you receive an audit notice regarding your IRS W-12, you should review the notice carefully and gather all relevant documentation. It’s wise to consult with a tax professional for guidance on how to respond appropriately, ensuring that you provide all requested information to avoid further complications.

Are there any specific troubleshooting steps for e-filing my IRS W-12?

When e-filing your IRS W-12, ensure your software is up-to-date and compatible with IRS systems. Common issues may arise from incorrect input formats or missing information; therefore, running a pre-submission check through the software can help identify potential errors before submission.