Who must file the Form W-12?

Anyone who is a paid tax return preparer must apply for and receive a preparer tax identification number (PAIN). EA's also must obtain a PAIN. The PAIN must be renewed annually. For purposes of determining who must obtain a PAIN, a tax return preparer is any individual who is compensated for preparing, or assisting in the preparation of, all or substantially all of a tax return or claim for refund of tax.

What is the purpose of the Form W-12?

Use this form to apply for or renew a PAIN.

What documents must accompany the Form W-12 form?

If you have an SSN and are applying for a PAIN and:

-

you have never filed a U.S. federal income tax return;

-

you have not filed a U.S. federal income tax return to the past 4 years; or

-

you do not have a U.S. federal income tax filing requirement,

then you must submit a paper PAIN application along with two identity verification documents.

You must submit an original or certified copy of your social security card along with an original or

certified copy of one other government-issued document that contains a current photo ID, for instance:

(a) Passport/Passport Card, (b) Driver's License, (c) U.S. State ID Card, (d) Military ID Card, or (e) National ID Card.

If you submit Form 8945 or Form 8946 with the Form W-12, refer to those form instructions for required

documentation.

What information should be provided?

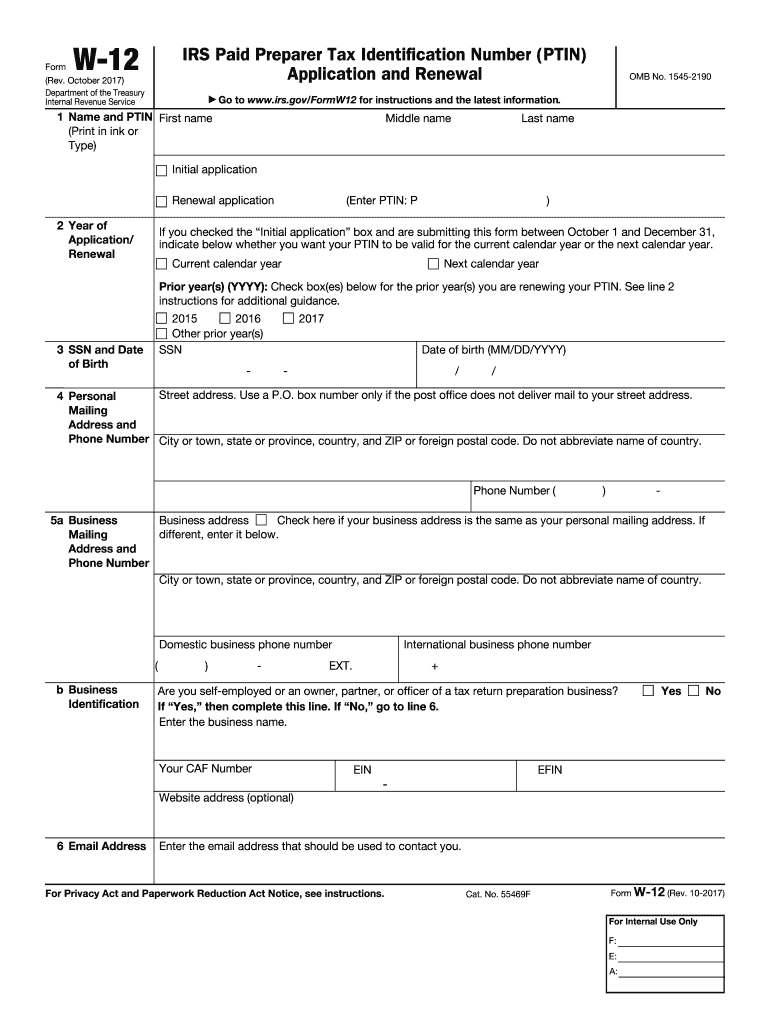

The Form W-12 contains the following blocks:

- Name and PAIN;

- Year of Application/Renewal;

- SSN and Date of Birth;

- Personal Mailing Address and Phone Number;

- Business Mailing Address and Phone Number;

- Business Identification;

- Email Address;

- Past Felony Convictions;

- Never Filed a U.S. Federal Income Tax Return / Address of Your Last U.S. Individual Tax Return Filed;

- Filing Status and Tax Year on Last U.S. Individual Income Tax Return Filed;

- Form 1040 Preparation;

- Federal Tax Compliance;

- Personal Credentials;

- Fee; and

- Signature and Date block.

How do I file the Form W-12?

There are two ways to file the form:

-

Online. Go to the webpage www.irs.gov/ptin for information. Follow the instructions to submit Form W-12 and pay the fee. If you submit your application online, your PAIN generally will be provided to you immediately after you complete the application and pay the required fee.

-

By mail. Complete the Form W-12 and send it along with a check or money order for the fee to:

IRS Tax Pro PAIN Processing Center

104 Brooke ridge Drive #5000

Waterloo, IA 50702

Allow 4 to 6 weeks for processing of paper Forms W-12.